What does a Los Angeles home appraiser do?Purchasing a home is one of the most significant investments that the average person might consider during their lifetime and isn’t to be taken lightly. Whether it’s the desire to settle down and raise a family or simply own a seasonal vacation home, the factors that drive purchasing a home are unique but the process is the same. And no matter the justification, buying a piece of property is a complex financial transaction that requires multiple people working together in cohesion.

But where do all the prices come from? What happens when the seller only wants to sell for $2 million but the buyer thinks the property is worth $500,000? That’s where the Los Angeles home appraiser comes in- providing an unbiased estimate of the property’s worth on a parcel of real estate, for which the buyer and the seller are both informed parties.

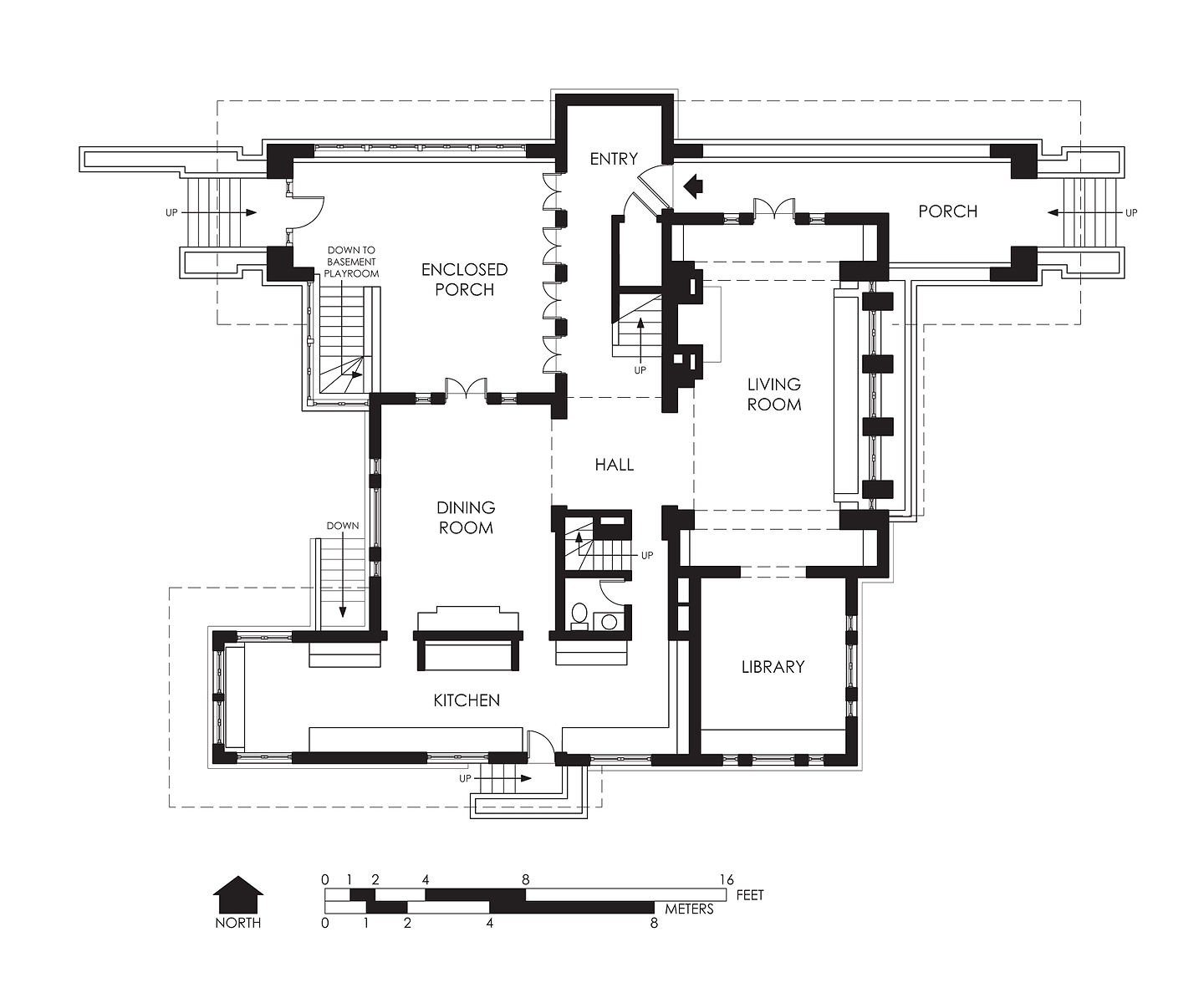

In order to provide an accurate evaluation, it is the appraiser’s responsibility to first complete a thorough examination of the property. The actual physical features of the house, such as the amount of bedrooms and bathrooms, the location, etc. need to be inspected to make sure they are actually present and in the proper condition. The examination often includes a sketch of the floor plan and an architectural blueprint as well, highlighting the square footage and illustrating the layout of the property, which in many cases can have a major influence on the value of the property due to individual preferences. Perhaps most importantly, the appraiser is responsible for identifying the most outstanding amenities or defects that can affect the overall value of the house. After the inspection, the appraiser uses his knowledge of valuation and the surrounding markets to determine the absolute value of the property in question, using industry techniques such as a sales comparison, replacement cost calculation and an income approach when rental properties are useful. Replacement Cost

The appraiser uses information and his knowledge of local building costs, costs of labor and other factors to calculate the expenses associated with replacing the property in question. The estimate typically sets the maximum range that the property can sell for, and is also the indicator of value that is least used in the housing market. Analyzing Comparable Sales

Los Angeles home appraisers are very familiar with the subdivisions in which they work, and as such our team has an in depth understanding of the value that particular features add to a home and provide for potential homeowners within that area. The appraiser is then responsible for researching recent transactions in close proximity to the property in question and finds other properties that are similar or possess similar qualities. These qualities, room layout, appliance upgrades, extra bedrooms, unique construction, etc. get certain dollar signs attached to them depending on how valuable they are in the area at hand. (Think for example of a fireplace and its worth in Los Angeles versus the Mid-West) Finally, the appraiser adjusts the juxtaposed properties so that they become more appropriately in line with the selected property. Comparable sales is typically the valuation approach that is most highly regarded and used the most frequently within the housing market. Valuation Using the Income Approach

In the case of properties that produce revenue – for example a condo or other form of rental house – the Los Angeles home appraiser may use a final approach in determining its value known as the income approach. In this particular situation, the amount of income that the real estate generates from the property in question is factored in with other, comparable rental properties in the area to try and determine a more accurate, current value.  Reconciliation

Taking in all of this information, the appraiser comes up with an estimated market value for the property at hand. This estimate, placed on the appraisal report, does not always end up being the sale price for the property even though it is the most likely indicator of the property’s true market value. Often the sales price fluctuates, driven up or down by other factors such as a bidding war between parties or the urgency of the seller/buyer to complete the transaction. Either way, the value determined by the appraiser is the value most often used as a starting point in the deal, and Appraising L.A. guarantees you the most accurate, professional property value so that you can make the most informed decisions regarding your personal real estate. |

|||||||||

Got a Question?

Do you have a question? We can help. Simply fill out the form below and we'll contact you with the answer, with no obligation to you. We guarantee your privacy.

Appraisers begin with the property inspection

Appraisers begin with the property inspection